CALL FOR AN APPOINTMENT TODAY!! 352.371.8400

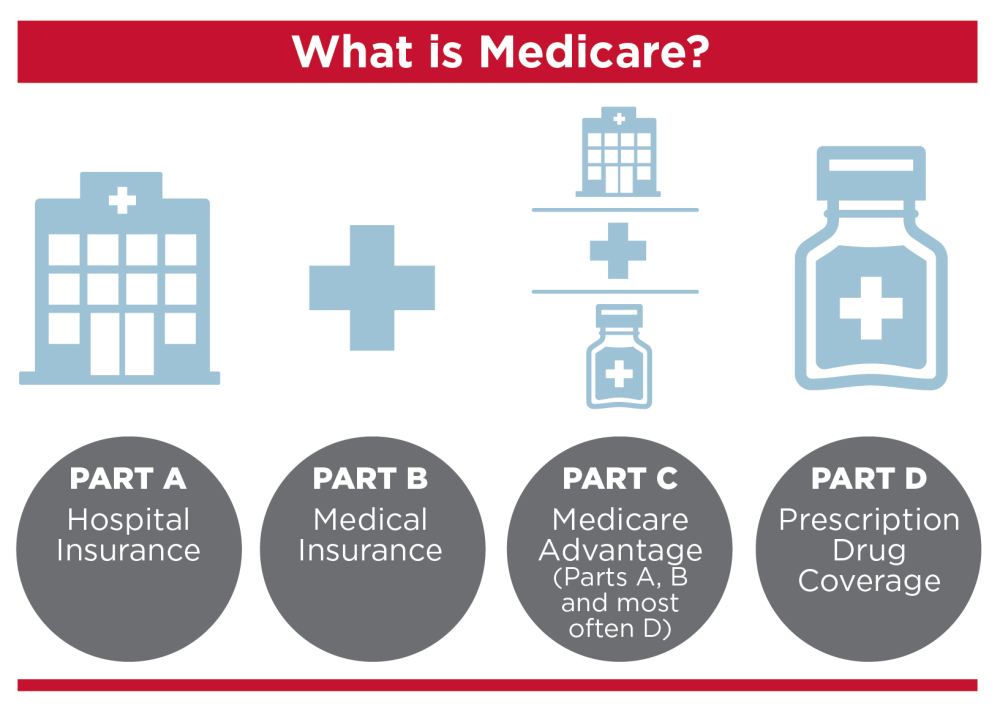

Medicare Part A is sometimes referred to as ‘hospital insurance’ and provides help with the cost of inpatient services, such as:

+inpatient hospital stays

+skilled nursing services

+home health care

+and hospice care

+skilled nursing services

+home health care

+and hospice care

However, Part A does not cover all of your hospital costs – as there are exclusions and out-of-pocket costs you are responsible for (i.e. hospital deductible and co-payments, private-duty nursing, comfort or convenience items, etc.).

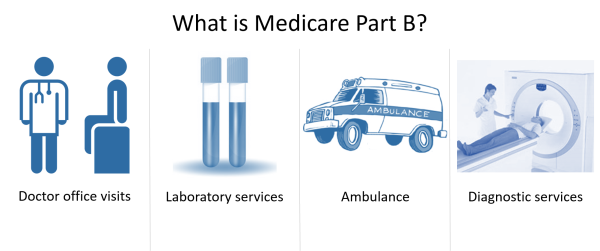

Medicare Part B is sometimes referred to as ‘medical insurance’ and provides help with the cost of outpatient services, such as:

+doctor office visits

+laboratory services

+ambulance fees

+diagnostic services (X-rays, MRIs, CT Scans, EKGs, etc.)

+laboratory services

+ambulance fees

+diagnostic services (X-rays, MRIs, CT Scans, EKGs, etc.)

For most people, Medicare Part B comes with a monthly premium which is often automatically deducted from your Social Security check each month.

The Part B premium is calculated based on your income.

You may also be subject to a penalty if you do not enroll in Part B when you are first eligible

.

However, Part B does not cover all of your medical costs – as there are exclusions and out-of-pocket costs you are responsible for (i.e. medical deductible and co-insurance).

Medicare Part C (otherwise referred to as Medicare Advantage) plans are offered through private insurance companies and they combine:

+all the benefits of Parts A & B

+prescription drug coverage (Part D) is included in many Part C plans

+plus additional benefits and built-in programs

+prescription drug coverage (Part D) is included in many Part C plans

+plus additional benefits and built-in programs

So Medicare Advantage plans provide help with the medical services that you get with Original Medicare (Parts A & B), plus many Medicare Advantage plans also include prescription drug coverage. They also often have additional benefits and built-in programs bundled with the plan, for example: vision, hearing, dental, fitness programs, etc.

It is important to understand that these plans typically have low or no monthly premiums. Meaning, you do not have to pay an additional premium up front each month to have the policy in place. Instead, there are fixed co-payments for services and you ‘pay as you go’.

Remember: you must always continue to pay your Medicare Part B premium.

Medicare Part D Plans (otherwise referred to as prescription drug plans) are offered through private insurance companies and provide help with the cost of prescription drugs. These plans may be purchased either as a stand-alone (Part D) prescription drug plan or as part of a Medicare Advantage (Part C) prescription drug plan. Medicare Part D plans have monthly premiums which vary depending on which plan you choose. You may also be subject to a penalty if you do not enroll in Part D when you are first eligible.

There are several Medicare Part D plans to choose from, varying in cost and in their formulary (or list of specific drugs covered), but all are structured in the same way. Meaning, there are 3 stages of drug coverage:

1. Initial Coverage Stage: during this drug stage you pay a co-pay (flat fee) or co-insurance (percentage of a drug’s total cost) for each prescription that you fill until your total drug costs reach a specified limit set each year.

2. Coverage Gap Stage (“Donut Hole”): after your total drug costs reach the Initial Coverage Stage limit, you enter the coverage gap stage – where you pay a percentage of the cost for brand name and generic drugs. You stay in this stage until your out-of-pocket costs reach the next limit set each year.

3. Catastrophic Coverage Stage: after your out-of-pocket costs reach the Coverage Gap Stage limit, you enter the catastrophic coverage stage – where you pay a small co-pay or co-insurance amount for each prescription. You stay in this stage for the remainder of the calendar year.

With all Medicare Part D plans, you will pay a share of the cost of the medications you take. Each plan that provides drug coverage, whether it’s a stand-alone plan or a Medicare Advantage plan with drug coverage built in, will include cost sharing and each plan will also share costs differently.

Medicare Supplement Plans (otherwise referred to as Medigap Plans) are offered through private insurance companies and provide help to fill in some or all of the gaps that Original Medicare (Parts A and B) do not cover. Both Part A and Part B are subject to deductibles, co-payments, coinsurance, and certain other limitations. Medigap Plans are designed to help fill many of those coverage gaps, and some even provide benefits that Original Medicare does not include.

Medicare Supplement Plans are secondary to Original Medicare, meaning you can add a Medicare Supplement Plan to Original Medicare to help pay for costs not covered. In other words, they help to wrap around Original Medicare (Parts A and B).

Remember: you must always continue to pay your Medicare Part B premium.

Medicare Supplement Plans vary in which gaps in coverage they fill, but as a general rule the more generous the coverage, the higher the premium. There are ten standard plans which are regulated by federal and state laws, however not all plans are available in all states. To keep it simple, all policies with the same letter offer the same benefits.

Proverbs 16:31 "The hoary head is a crown of glory, if it be found in the way of righteousness. (NKJV)"